Get a demo

of Voyado

We love all things customer and product data, and would love to chat about your brand’s individual challenges, and how our solutions can help.

- Understand your customers by tracking behaviors.

- Offer instantly relevant product recommendations and search.

- Automate it! Emails, SMS, social connect, push notifications and more.

Voyado Engage

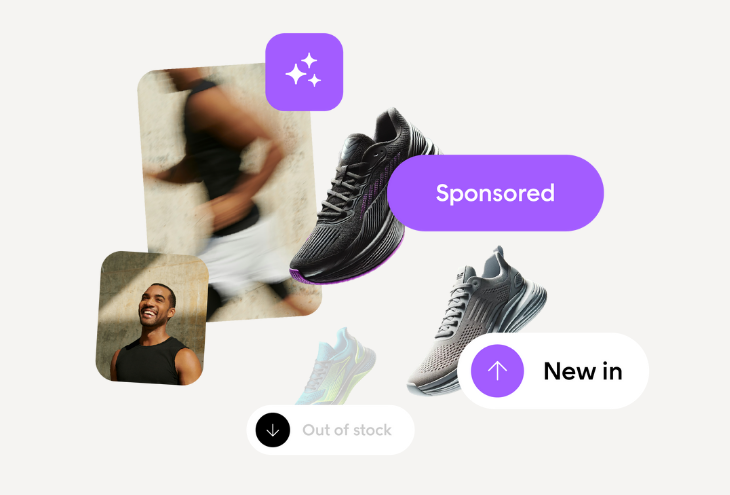

Voyado Engage  Voyado Elevate

Voyado Elevate  Powered by Bonnie AI

Powered by Bonnie AI